Riverhead Town Board members voted Tuesday to pursue mortgaging the town’s real estate at the Calverton Enterprise Park in order to plug an estimated $4 million budget gap next year — and avoid either a 16-percent property tax increase or “catastrophic” budget cuts, according to Supervisor Sean Walter.

The borrowing would also help fund the Calverton Sewer District upgrade and expansion, providing infrastructure needed for future development there.

Walter is calling the mortgage a “bridge loan,” meaning the town is looking to leverage its equity in the Calverton real estate — it owns 600-plus acres of developable land at the site — to access cash it needs to stay afloat until the land can be subdivided and sold.

The supervisor and town board are hoping the borrowing will be short-term, because Riverhead is already struggling under the weight of a debt burden the supervisor calls “crushing.”

The town’s total bonded indebtedness ballooned from $42.3 million in 2002 to $165.4 million in 2012 — nearly a 300 percent increase over the span of a decade. Most of that increase is attributable to two things: the aborted landfill reclamation/closure project (approximately $50,000,000) and borrowing against future 2-percent transfer tax revenues (approximately $70,000,000) to fund farmland and open space acquisitions.

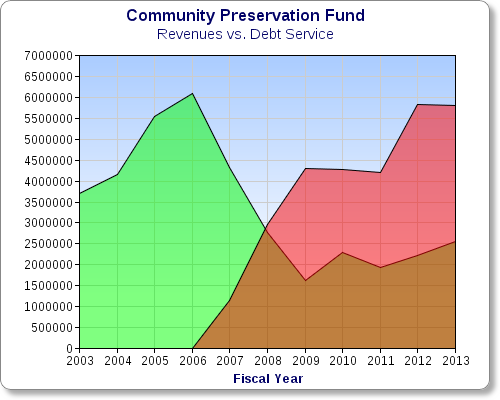

The 2-percent transfer tax revenues have not materialized as hoped. When the real estate market went bust in the last decade, land values plummeted and property sales declined dramatically. Since 2008, transfer tax revenues have lagged behind the annual payments of principal and interest due on the community preservation fund bonds, so the town has been using previously collected transfer tax revenues — kept in a segregated reserve fund — to make up the difference in CPF debt service due. For example, the CPF debt service (principal and interest) was $5,796,219 in 2013. CPF revenues (2-percent transfer tax receipts) were $2,562,000. The difference came out of the CPF reserve fund.

CPF debt clock is ticking

The CPF reserve is running out, however, and with annual 2-percent transfer tax revenues still less than half of what they were before the recession, the town is looking at another large budget gap within a couple more years.

If CPF revenues increase steadily — albeit slowly, as they have since 2011 — at the rate of about 15 percent per year, CPF revenues in 2017 will be about $1 million short of the $5,480,886 due on the CPF bonds. At that point, the CPF reserve fund will be depleted and the difference will have to be paid out of the town’s general fund.

The supervisor says he’s hoping for relief from Albany. He plans to ask lawmakers for special legislation that would allow the town to extend the bond repayment time, he said last week.

Officials are also hoping the local real estate market returns to life and transfer tax revenues increase to the levels seen in the mid-2000s, which would cover the CPF debt service. Even a boom like that would not produce excess revenues to fund substantial new land preservation purchases until after the debt is significantly paid down.

Large land sales at EPCAL will also bolster CPF coffers, Walter noted.

“It all comes back to EPCAL,” he said.

| FISCAL YEAR |

TOTAL LONG-TERM DEBT as of 12/31 |

| 2002 | 42,286,987 |

| 2003 | 93,087,650 |

| 2004 | 87,249,895 |

| 2005 | 96,737,637 |

| 2006 | 100,693,195 |

| 2007 | 110,590,001 |

| 2008 | 138,024,000 |

| 2009 | 149,176,697 |

| 2010 | 145,672,055 |

| 2011 | 165,213,755 |

| 2012 | 165,401,902 |

Issued 01/01/2003: $34,751,000

Issued 12/15/2003: $33,165,000

Issued 08/01/2005: $15,435,000

Issued 12/01/2006: $27,250,000

Issued 02/01/2008: $35,349,000

Issued 11/29/2011: $22,041,000

The survival of local journalism depends on your support.

We are a small family-owned operation. You rely on us to stay informed, and we depend on you to make our work possible. Just a few dollars can help us continue to bring this important service to our community.

Support RiverheadLOCAL today.